Brazilian Software Market Study – Overview and Trends points to above-average growth for the Brazilian market

ABES – Brazilian Association of Software Companies released the update of the study “Brazilian Software Market 2022 – Overview and Trends”, carried out with data from IDC, in a fully virtual event held on the 18th of May. Information on investments and perspectives for the ICT sectors in Brazil and in the world was presented.

The presentation was led by Paulo Milliet Roque, president of ABES, with the participation of Jorge Sukarie (advisor of ABES) and Fabio Martinelli (leader of the Software and Cloud Computing programs at IDC). “We are increasingly committed to providing content and services that contribute to the construction of a digital and less unequal Brazil, in which information technology plays a fundamental role in the democratization of knowledge and the creation of new opportunities for all, in a way that inclusive and egalitarian. Therefore, we work to ensure a business environment conducive to innovation, ethical, dynamic, sustainable and globally competitive”, declares Paulo Milliet Roque.

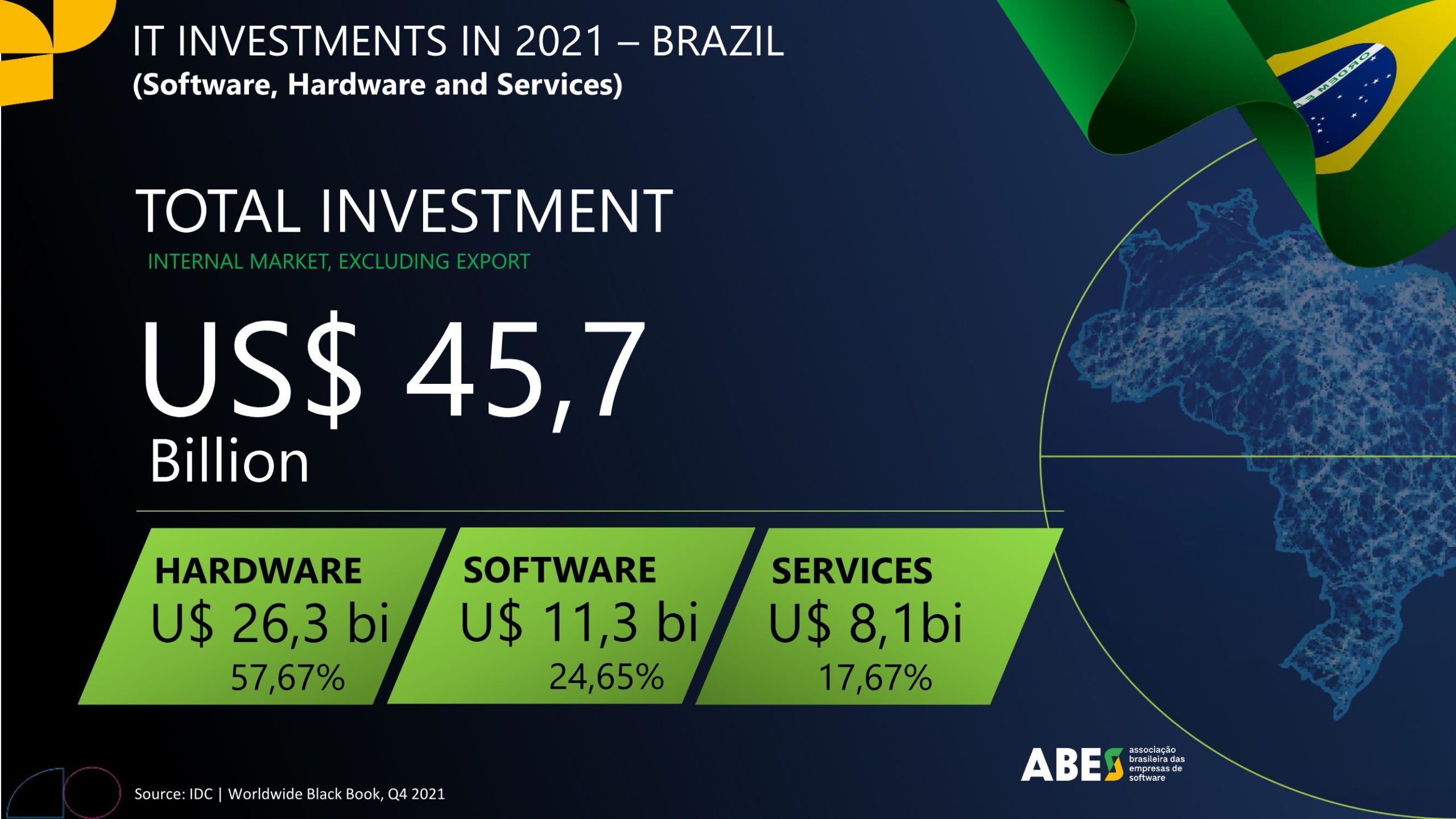

To get an idea of some of the results presented, Brazil currently holds 1,65% of investments in technology at a global level, and 40% of investments throughout Latin America. Considering the total global investments in information technology (software, hardware and services) during the year 2021 – which was US$ 2.79 trillion –, our country ranks tenth in this investment ranking, with US$ 45 .7 billion invested, and leads in Latin America, whose total investments reached US$ 115 billion.

ABES also highlighted during the event that Brazil continues to be a reference among the countries considered emerging, presenting a high degree of maturity in IT investments – which prioritizes the values dedicated to software development and increase in the offer of services. The total applied is distributed in 25% for the software market (U$ 11.3 billion), 18% for the services market (U$ 8.1 billion) and 58% for the hardware market (U$ 26.3 billion) , which shows that the country is moving towards the global average, whose distribution is 26% in software, 27% in services and 47% in hardware.

According to Jorge Sukarie, counselor at ABES, Brazil also showed a slight increase in the dispersion of IT investments across the country. “The increase in participation in IT investments in the last decade, in the Northeast and North regions, was 1%, while in the South region the increase in participation was 2%. In the Southeast and Midwest regions, the drop in participation in total IT investments was 2%”, he highlights. This does not mean that the Southeast and Central-West regions did not grow in terms of IT investments, but that they grew proportionally less than the other regions that registered an increase in their participation in IT investments.

On the other hand, the growth of the technology market, at a global level, was 11% in 2021 – however, in the same period, Brazil presented a higher growth, of 17%, which shows the country's potential in this segment. “The trend for 2022 is that there will be a global growth of around 6.4%, and Brazil, once again, should present rates well above average, since the expectation of growth in our market is around 14.3%, behind only Turkey, whose growth is estimated at 16% for this year”, points out Jorge Sukarie.

Fabio Martinelli, leader of the Software and Cloud Computing programs at IDC, highlights the importance of the event for the democratization of information about the technology market in Brazil. “We will take this time to talk about market trends in technology application, targeting the business recovery journey and how companies advance in the application of technology to drive innovation in an increasingly digital economy. The study aims to deepen knowledge of the ICT-related market in Brazil, in addition to mapping the impacts of Digital Transformation (DX) on companies”, explains the executive.

Check out other trends presented:

- 5G deployment: IDC estimates that 5G will move around US$ 25.5B in Brazil by the year 2025, boosting technologies such as AI, Big Data & Analytics, Cloud, Security, AR/VR, Robotics and IoT.

- IoT: In 2022, a total of US$ 1.6B is expected to be directed towards Internet of Things related services solutions, which represents a growth of 17.6% over the previous year.

- Cybersecurity: Security services will total almost US$1B in Brazil in 2022, which represents an average growth of almost 10% YoY since the pandemic. Security solutions will surpass US$ 860M this year, with cloud receiving great attention.

- Hybrid Environment (Cloud): Public cloud infrastructure as a service (IaaS) spending will reach US$1.9B in 2022, with growth above 36%. Private cloud maintains a more discreet growth pace, advancing 7.9% and reaching spending of US$ 540M in Brazil.

- Use of Data: In 2022, a total of US$ 2.9B is expected to be directed towards Big Data & Analytics solutions and services, which means an increase of 10.8%. For AI/ML, the expected growth for spending in 2022 is 28% YoY, reaching an amount of US$504M.

The entirety of Brazilian Software Market Study – Overview and Trends can be downloaded for free at the link, in order to collaborate in decisions on IT investments and in the elaboration of strategies. To watch the event in full, go to ABES YouTube channel.