It is estimated that more than 180 thousand occurrences in the week of the commemorative date

In the week of Mother's Day (May 6th to 12th), the second most important commemorative date for commerce, behind only Christmas, Serasa Experian projects that more than 180 thousand identity fraud attempts will be avoided. If implemented, they could cause more than R$ 1 billion in financial losses for businesses and consumers. Considering only the Mother's Day weekend, the estimate is that 78.5 thousand fraudulent occurrences will be stopped, which would generate losses at the level of R$ 439.6 million. If the numbers are confirmed, in practice, the money will no longer go into the pockets of criminals.

For the director of Serasa Experian, Caio Rocha, as it is one of the most significant dates for Brazilian commerce, scammers are alert to creating false purchasing opportunities that, in the end, can lead to the theft of important personal information that will be used for situations serious issues, such as opening false accounts and requesting loans without consent.”

Identity fraud occurs as follows: criminals use the victim's personal data, such as CPF, ID, email, photos and other information to carry out transactions on behalf of third parties, usually in financial institutions. Unfortunately, the victim only realizes that they had an account opened in their name or was hacked months later, when they receive unknown charges.

“Many attractive offers may appear on the internet that require you to fill in personal data. Therefore, consumers need to be careful about where they share their personal information to avoid becoming victims of identity theft”, warns Rocha.

How can companies protect themselves?

To avoid fraud, companies need to have a continuous authentication strategy, which combines layers of protection at all stages of the journey, ensuring that the consumer carrying out a transaction is, in fact, who they say they are. Additionally, it is important:

- Value authentication with as little friction as possible in the customer experience;

- Alert customers about common scams in the segment;

- Protect your online payment platforms;

- Analyze consumption profiles and behaviors with a higher risk index;

- Have solutions that keep up with the evolution of scams, keeping the consumer protected in the fraud prevention process and combining technology, data and analytical intelligence.

How can consumers protect themselves?

It is important that consumers protect their data by maintaining some good practices in their daily lives, such as:

- Choose reliable and reputable websites and stores;

- Be wary of very attractive offers;

- Read reviews and opinions about the product and establishments you have never interacted with;

- Be careful with freebie scams and do not make payments for unsolicited deliveries;

- Be careful with links shared in social media message groups or SMS;

- Register your Pix keys only on official bank channels, such as the banking app, Internet Banking or branches;

- Do not provide passwords or access codes outside the bank's website or application;

- Do not lend or sell your data;

- Do not make transfers to friends or relatives without confirming by phone call or in person that it really is the person in question, as the person's contact details may have been cloned or falsified;

- Only include your personal information and card details if you are sure that it is a secure environment;

- Keep your devices updated;

- Ensure that your documents, cell phones and cards are secure and have strong passwords to access applications;

- Create secure passwords and update them frequently;

- Monitor your CPF frequently to ensure you have not been a victim of fraud.

Serasa Experian reiterates its commitment to protecting people and companies against fraud, providing educational content to prevent this throughout the year. Furthermore, in November 2023, Datatech confirmed the integration of AllowMe, a reference company in risk analysis of devices against fraud, into its operations, expanding its portfolio and expertise in preventing fraud of the most diverse types in the country.

Methodology

Serasa Experian estimated the risk of fraud on Mother's Day 2024 based on data from the same period in 2023.

When suffering some type of fraud attempt, companies expressed concern about issues related to information security, mainly “Customer Data Leakage” (49%) and “Financial Losses” (48%), followed by “Own Data Leakage ” (39%), “Default” (35%), “Theft of Strategic Information” (34%), “Identity Fraud” (28%) and, finally, “Loss of goods” (16%).

For the Director of Fraud Prevention and Authentication, Caio Rocha, “technology has allowed companies to connect globally, expand their markets and reach customers more efficiently. But at the same time, digitalization has also opened doors for fraudsters to improve their scams. Hackers and criminal groups are increasingly sophisticated, exploiting vulnerabilities in systems, networks and applications. Therefore, companies must recognize the critical importance of becoming more aware of fraud and layered protection is essential to mitigate risks and ensure the security of operations and customers. Investing in robust prevention and detection strategies is essential for the sustainability and trust of organizations.”

Attention to all layers of protection

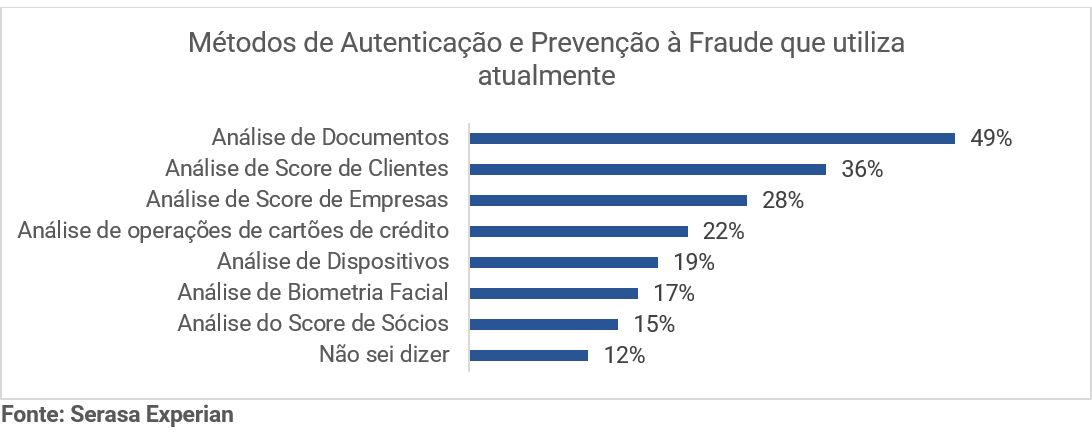

To prevent fraud, the research also revealed that companies consider the layers essential, the main ones being “Document Analysis” (49%), “Customer Score Analysis” (36%), “Company Score Analysis” (28%), “Analysis of credit card operations” (22%) and “Device Analysis” (19%). Check out the complete ranking:

Methodology

331 legal entities (PJs) participated in the interview, considering the classification established by SEBRAE. The research sought to cover several sectors, including commerce, services and industry, as well as companies operating in both the B2B and B2C markets. The survey was administered via an online panel in November 2023, of which 49% are from the Southeast region, 20% from the Northeast, 16% from the South, 9% from the Central-West and 6% from the North. Of the total number of responding companies, 71% are “private and national”, 16% “private and multinational” and 13% “state-owned”. In relation to the companies segment, 60% are from “Services”, 18% from “Retail Trade”, 5% from “Wholesale Trade” and 5% from “others”. The size of the companies was divided into “Micro” (37%), “Small” (21%), “Large” (16%), “Over 1,000” (15%) and “Medium” (12%).

Avoid fraud: see tips from Serasa Experian experts to protect yourself

Consumers:

- Ensure that your document, cell phone and cards are secure and have strong passwords to access applications;

- Be wary of offers of products and services, such as travel, with prices well below the market. At these times, it is common for cybercriminals to use the names of well-known stores to try to invade your computer. They use emails, SMS and website replicas to try to collect information and credit card details, passwords and personal information from the buyer;

- Be careful with links and files shared in social media message groups. They can be malicious and lead to unsafe pages, which contaminate devices with commands to operate without the user noticing;

- Register your Pix keys only on official bank channels, such as the banking app, Internet Banking or branches;

- Do not provide passwords or access codes outside the bank's website or application;

- Do not make transfers to friends or relatives without confirming by phone call or in person that it really is the person in question, as the person's contact details may have been cloned or falsified;

- Only include your personal information and card details if you are sure that it is a secure environment;

- Monitor your CPF frequently to ensure you have not been a victim of fraud.

Companies:

- With the acceleration of the adoption of digital channels in consumers' lives, companies are increasingly investing in anti-fraud solution methods and sophisticated technologies throughout the customer journey, so that operational security is guaranteed, with as little friction as possible. in your experience. In this sense, Serasa Experian has intelligent modular solutions that make it possible to offer a safe experience to the end customer. With a combination of big data, analytics and automated solutions, companies can protect their businesses against fraud while maintaining the best experience for their users.

- Perform purchase analysis: invest in anti-fraud predictive layers, especially those that perform behavioral analysis of your customers and users. Thus, your company can evaluate the consumer's history in the market, the status of their CPF or CNPJ, their habits and the existence of pending issues in their name, for example;

- Check registrations. Having a customer database is essential to reinforce the security of online operations. In this regard, having access to an updated consumer register, in which it is possible to check the veracity of the information provided at the time of a purchase, for example, is a strategy to reduce risks when selling. Registration confirmation can identify fraud attempts, signaling suspicious situations, such as discrepancies in customer data with those contained in other reliable databases;

Invest in anti-fraud solutions layered: there is no silver bullet that works for all cases. Therefore, it is important to equip your business with cutting-edge technologies that, combined, help to shield all stages of your customer's journey.