Citizens aged 36 to 50 were the main targets, and “Banks and Cards” was the segment with the highest incidence of unsuccessful attacks

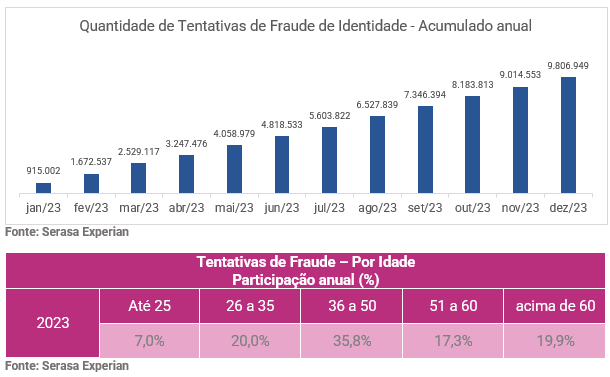

The year 2023 recorded a total of 9,806,949 identity fraud attempts, which were unsuccessful thanks to Serasa Experian's authentication and scam prevention tools. Consumers aged 36 to 50 were the main targets of criminals in the period (35.8%). See the complete data in the graph and table below:

The data comes from Serasa Experian's Fraud Attempt Indicator and also shows the ranking of the segments most attacked by fraudsters: Banks and Cards (48.1%), Services (30.6%), Finance (16.3%), Retail (3.6%) and Telephony (1.4%). According to the Director of Authentication and Fraud Prevention at Serasa Experian, Caio Rocha, the attempts were identified and blocked by authentication and fraud prevention tools, based on document verification (analysis of identification documents), facial biometrics and registration verification.

“Our recommendation is that companies invest in a layered protection format so that they can enhance the identification and management of fraud attempts at all stages of an end user's journey, from registering on a website or application to completing a transaction. transaction or purchase. After all, there is no “silver bullet” against fraud or “ready recipe”: the flow of layers for this purpose must be built taking into account the business model, exposure and types of risk, the regulation of each segment and, mainly, the user experience – which must be minimally impacted so as not to make business unviable”, declares the executive.

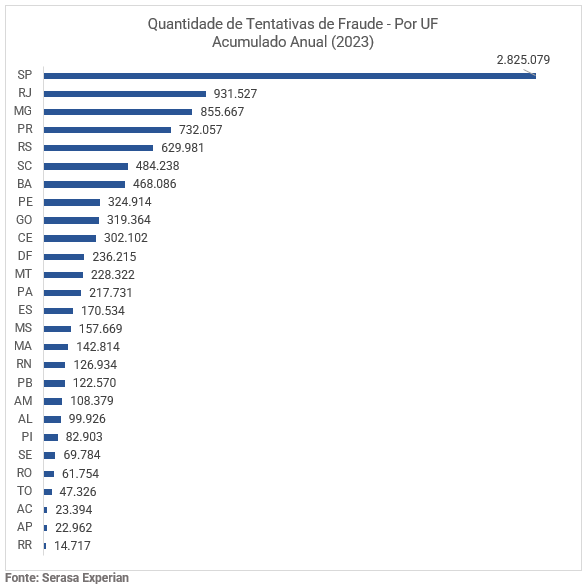

Concentration of coup attempts in the South and Southeast regions

The indicator data also shows that the states in the South and Southeast regions were the most targeted by criminals to commit identity fraud. See, in the graph below, the volume of inquiries by Federative Unit (UF):

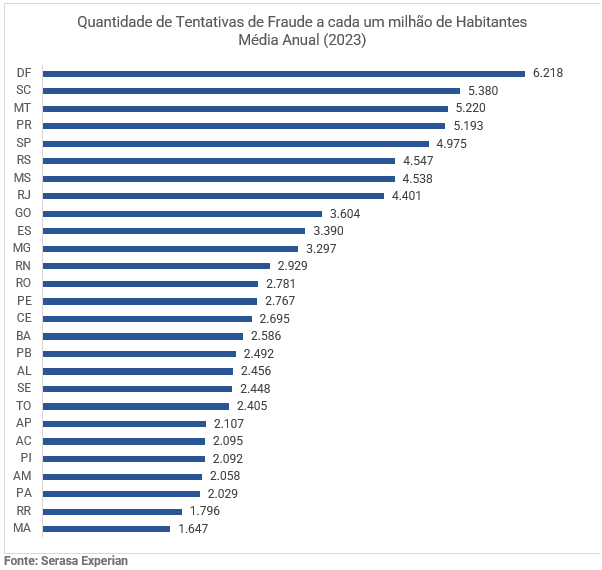

Attempts per million inhabitants

The annual average was 3,780 fraud attempts per one million inhabitants in 2023, with the Federal District leading the ranking with 6,218. Check out the complete list in the chart below:

Southeast in the crosshairs of criminals

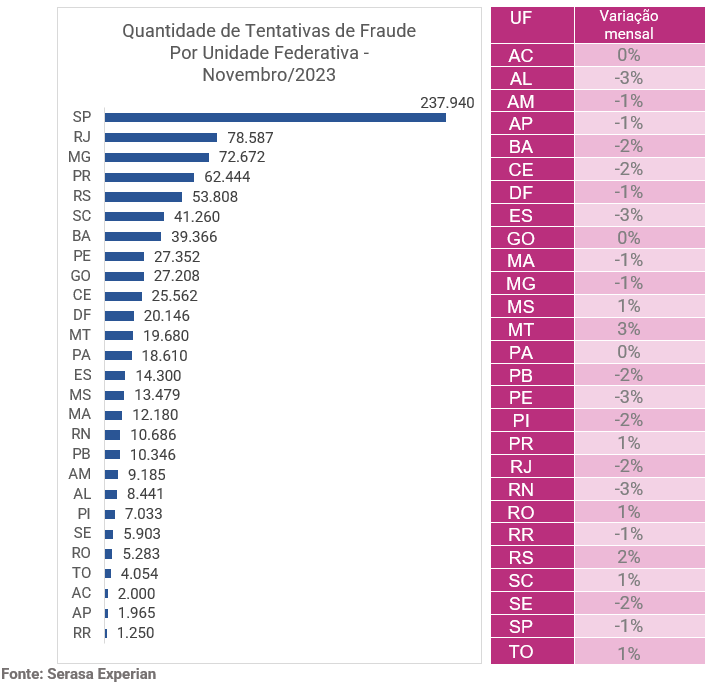

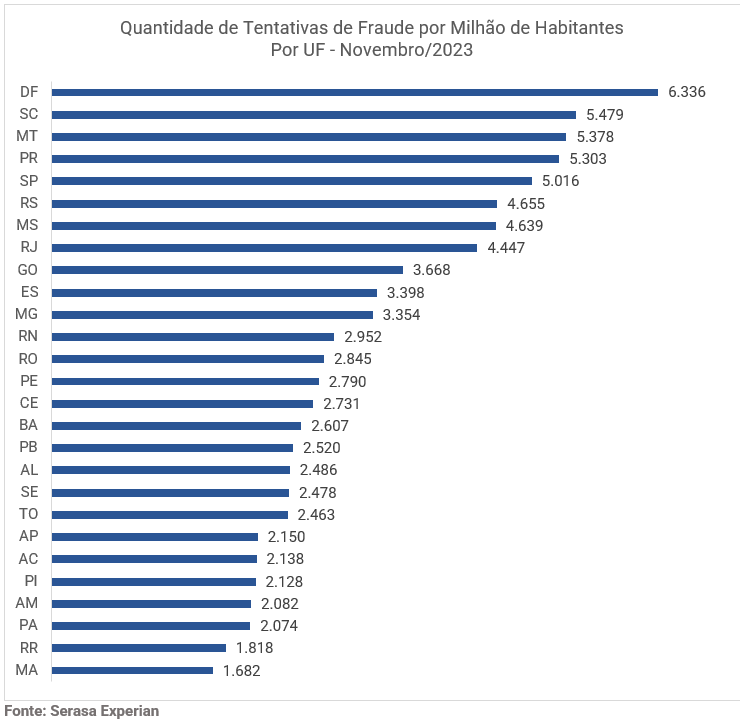

In November, three of the four Federative Units (UFs) in the Southeast led the ranking with the highest volume of fraud attempts. Of the total states, 17 recorded a drop in coup incidents compared to the previous month. See the state survey in the graph below and the monthly variation in the table to the side:

Attempts per million inhabitants

There were 3,833 fraud attempts per million inhabitants in Brazil in November. In terms of UFs, the Federal District led the ranking with 6,336 and Maranhão appeared with the lowest number in this section (1,682). Check the breakdown by UFs below:

Avoid fraud: see tips from Serasa Experian experts to protect yourself

Consumers:

- Ensure that your document, cell phone and cards are secure and have strong passwords to access applications;

- Be wary of offers of products and services, such as travel, with prices well below the market. At these times, it is common for cybercriminals to use the names of well-known stores to try to invade your computer. They use emails, SMS and website replicas to try to collect information and credit card details, passwords and personal information from the buyer;

- Be careful with links and files shared in social media message groups. They can be malicious and lead to unsafe pages, which contaminate devices with viruses to work without the user noticing;

- Register your Pix keys only on official bank channels, such as the banking app, Internet Banking or branches;

- Do not provide passwords or access codes outside the bank's website or application;

- Do not make transfers to friends or relatives without confirming by phone call or in person that it really is the person in question, as the person's contact details may have been cloned or falsified;

- Only include your personal information and card details if you are sure that it is a secure environment;

- Monitor your CPF frequently to ensure you have not been a victim of any Pix fraud.

Companies:

- With the acceleration of the adoption of digital channels in consumers' lives, companies are increasingly investing in new methods of anti-fraud solutions and sophisticated technologies throughout the customer journey, so that the security of the operation does not affect their integrated experience. Serasa Experian, for example, has intelligent modular solutions and a team of experts that make it possible to offer a safe and frictionless experience to the end customer. With a combination of data, analytics and automated solutions, companies can safely expand their business.

- Count on online payment platforms. The company that wants to act online, providing services or selling products, needs to pay the utmost attention to payments. It is necessary to adopt a system that combines speed in the processing of transactions with security;

- Carry out purchasing analysis: invest in credit and fraud predictive layers, especially those that perform behavioral analysis of your customers and users. Thus, your company can evaluate the consumer's history in the market, the status of their CPF or CNPJ, their habits and the existence of pending issues in their name, for example;

- Check registrations. Having a customer database is essential to reinforce the security of online operations. In this regard, having access to an updated consumer register, in which it is possible to check the veracity of the information provided at the time of a purchase, for example, is another strategy to reduce risks when selling. Registration confirmation can easily identify fraud attempts, signaling suspicious situations, such as discrepancies in customer data with those contained in other reliable databases;

- Invest in anti-fraud solutions layered: there is no silver bullet that works for all cases. Therefore, it is important to equip your business with cutting-edge technologies that, combined, help to shield all stages of your customer's journey.

Methodology

The Serasa Experian Fraud Attempts Indicator – Consumer is the result of crossing two sets of information from the Serasa Experian databases: 1) total CPF consultations carried out monthly at Serasa Experian; 2) estimation of the risk of fraud, obtained through the application of probabilistic fraud detection models developed by Serasa Experian, based on Brazilian data and global Experian technology already consolidated in other countries. The Serasa Experian Fraud Attempts Indicator – Consumer is constituted by multiplying the number of CPFs consulted (item 1) by the probability of fraud (item 2), in addition to adding the volume of fraud attempts registered by the company relating to document verification, facial biometrics and registration verification.