By Clarence Hempfield, Pitney Bowes Software vice president of product management and location intelligence

Property insurance begins to gain even more strength with the increase in natural disasters that has been observed in the last decade, as a result of both climate change and the increase in population and urbanization processes that are not always controlled. For insurance providers, understanding the dynamics of a storm and the geography of the projected impact zone is essential to business operation.

Home insurance providers need to know which of their insured properties, both commercial and residential, are in the path of a hurricane to determine whether they have sufficient reserves to offset potential losses. An example: in the USA, Hurricane Matthew, which swept the south coast of the US in September this year, put more than 5.5 million homes at risk and US$ 1.4 trillion in potential damage, according to geolocation data. from Pitney Bowes.

Location intelligence, or the enrichment and analysis of location data for better business conclusions, allows insurance providers to access the data needed to make these critical business decisions before, during and after a natural disaster.

The calm before the storm

From a business perspective, insurance companies examine new potential customers for their proximity to a nearby tropical storm. Specifically, they are trying to ensure that a reasonable amount of payments are made to compensate for any potential damages in any specific period of time.

Keeping accurate data on policyholders helps to validate claims after a storm and allows the insurer to provide a more efficient service. How does it work in practice? Homeowners will typically look to one or more insurance companies to answer a series of questions about the new property. These companies will use location and data intelligence technology to analyze the property using high-precision geocoding and other descriptive attributes for a specific location.

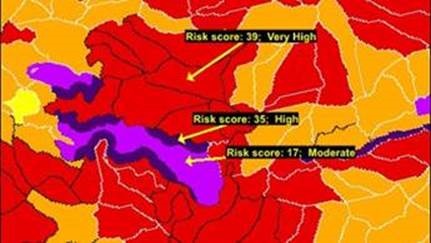

Insurance providers evaluate a series of spatial queries, combined with historical data, to quantify the potential risk to which the property is exposed (eg, the property that is in the water has a high risk of flooding or is in a prone area earthquakes). In the normal course of business, data is used to develop a risk profile that directly reports insurance rates.

Where the fire is hot

During a hurricane, insurance providers in the U.S. are using location intelligence to track imminent damage in real time. Location intelligence allows providers to constantly update their damage predictions based on risk data sets in a high-quality model of the storm path.

Information-based models better assess damage from a storm or hurricane in the neighborhood, so that insurance companies can correctly assess products to avoid unnecessary risks and still meet policyholders. The accuracy of the data feed for these models is of utmost importance. The difference between several thousand dollars of under- and over-valued payments could depend on the exact boundaries of a given flood zone.

The model is primarily used to forecast the hurricane intensity, the path, the height of the tide and the projected precipitation. However, other factors contribute to the total damage assessment. Insurance companies can then use these models in real time to make timely and actionable decisions to minimize their exposure to risk, position resources and reduce unnecessary expenses.

Its consequences

Finally, in the wake of a storm, location intelligence can be instrumental in calculating your return on investment. For example, Florida Farm Bureau Insurance operates in a state that is statistically susceptible to 50% damage from all hurricanes that occur in the United States.

When projecting the potential costs caused by a storm, Florida Farm Bureau uses geocoding to efficiently and accurately determine rates for its customers, in addition to decreasing the amount of time and effort involved in the registration process. The result is reduced operating expenses and increased profitability - specifically, a 900% return on investment in the first 10 months after the deployment of location intelligence technology.

Because Florida Farm Bureau was able to ensure the accuracy of the information in its databases, they were able to retain more customers through the policy renewal process. Florida Farm Bureau is also receiving fewer fines and criticisms from regulatory agencies, while eliminating many of the manual processes that agents previously used to validate insured information, according to a Pitney Bowes case study on Florida Farm Bureau.

For a Florida homeowner, during hurricane season, insurance rates are a reflection of immediate safety concerns. Human Resources departments can even use location intelligence to track their employees and send context-relevant communications before or during a major storm. However, for insurance companies, hurricanes represent an unpredictable corporate responsibility that can be managed through the use of this innovative technology.