*By Leonardo Melo Lins

*By Leonardo Melo Lins

In recent years, the increase in the number of Internet access providers in Brazil and its importance for expanding connectivity in the country has been widely debated. Furthermore, the provider merger and acquisition market was one of the busiest in recent years, involving investment funds and major market players. However, it seems that the scenario is now different, suggesting that there are strong consolidation trends in the sector.

According to the KPMG mergers and acquisitions report, in 2022, of the 1,728 transactions that took place, 640 involved Internet companies (in second place, the sector with the most transactions was information and communication technology (ICT), with 268 transactions ). However, it is important to highlight that, although the number of transactions in 2022 is lower than in 2021, it is still higher than in the other years of the series, highlighting the dynamism of the Internet and ICT sector[1].

Another source that points to interesting changes in the sector is the new version of the ICT Providers survey. The research is an extensive mapping of companies that provide internet access to end customers, analyzing various aspects of their operations and the technologies used[2].

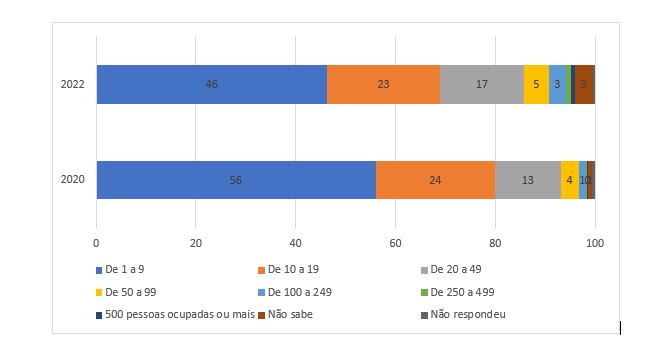

In its latest version, launched in December last year, the survey estimated a smaller number of companies effectively operating in relation to the year 2020: in 2022 there were 11,630 companies offering Internet access, compared to 12,826 companies in 2020. Still According to the ICT Providers survey, in 2020, 56% of providers were micro-enterprises, a proportion that rose to 46% in 2022, while the proportion of medium-sized companies (with 20 to 49 employed people) rose from 13% in 2020 to 17% in 2022. Therefore, the data indicate that there was a movement towards a reduction in the participation of micro-enterprises and an increase in the proportion of small and medium-sized companies in the provider market, pointing to a slowdown in the emergence of a company profile that was the main characteristic of the sector.

Graph 1 – PROVIDER COMPANIES, BY PERCENTAGE RANGE OF EMPLOYED PEOPLE (2020 – 2022)

Total number of provider companies (%)

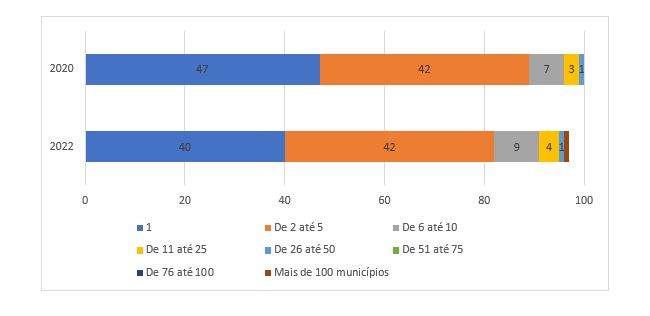

One of the main characteristics of the Brazilian provider market in its moment of expansion was the internalization of companies, bringing connectivity to the four corners of the country. Given the territorial extension and geographic diversity of Brazil, taking Internet access beyond the large centers is a major challenge. An interesting fact from TIC Providers is the reduction in the number of providers operating in just one municipality. In 2020, 47% of providers operated in just one municipality, a proportion that was 40% in 2022. Another interesting change was that the proportion of providers operating in 6 to 10 municipalities went from 7% in 2020 to 9% in 2022. This reduction in providers operating in only one municipality, related to the increase in operations in the range of 6 to 10 municipalities, may serve as indications of a consolidation movement in the sector, since there are fewer companies operating in isolation, while companies are beginning to emerge operating on a larger scale.

Graph 2 – PROVIDER COMPANIES, BY NUMBER OF MUNICIPALITIES IN WHICH THEY OPERATE AND SIZE (2020 – 2022)

Total number of provider companies (%)

What do these changes discussed above indicate? Firstly, it is important to highlight that there is greater competition in the sector, which despite leaving some companies along the way, boosts those providers that have a more qualified service, favoring the customer experience and the network as a whole. Secondly, a smaller number of companies points to greater specialization in the sector, which is also related to competition: more and more customers are looking for fast and stable connections, as well as secure handling of their personal data, in addition to The fact that connectivity is, nowadays, central to the provision of fundamental public services. Therefore, after a first moment in which small providers were crucial in the expansion of basic connectivity throughout Brazil, in which the competitive advantage was proximity to the customer, a period of greater professionalization and competition in the sector has now begun. , in which investments in connection quality and digital security will increasingly define which company survives.

*Leonardo Melo Lins is a Researcher at think tank from ABES, member of the IEA/USP Post-Doctoral Program and Analyst at Cetic.br | NIC.br

Notice: The opinion presented in this article is the responsibility of its author and not of ABES - Brazilian Association of Software Companies

***

[1] More information at: https://kpmg.com/br/pt/home/insights/2023/04/estudo-kpmg-analisa-mercado-fusoes-aquisicoes.html

[2] More information at: https://cetic.br/pt/publicacao/pesquisa-sobre-o-setor-de-provimento-de-servicos-de-internet-no-brasil-tic-provedores-2022/