*Per Vinicius Oliveira and Helder Santos

*Per Vinicius Oliveira and Helder Santos

In Brazil, in 2023, more than three million and eight hundred thousand new companies were created (AGENCIAGOV). All of these companies have something in common: taxes. Calculating, paying and declaring taxes becomes an important business activity for these companies, so that they can grow in a safe and efficient way.

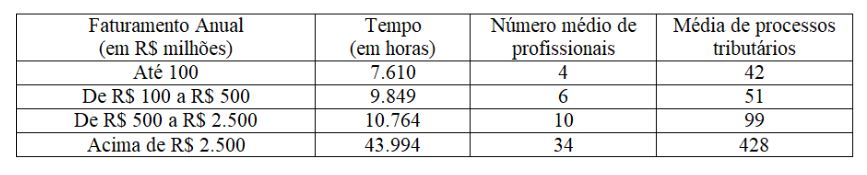

Brazilian companies spend between 7,000 and 43,000 hours per year to carry out tax assessment, declaration and payment activities. This data comes from Deloitte research, called “Tax of Tomorrow”, in which it evaluates several issues, related to the tax environment, which are on the agenda of executives at Brazilian and international companies. And, despite the significant amount of time spent on tax compliance, it is still necessary to manage a significant amount of tax disputes. The table below presents the research data.

On average, 60% of time is spent on tax pre-payment processes, with 30% dedicated to post-payment activities. This represents high costs for maintaining a business structure in Brazil. The World Bank study, called Doing Business, points out that the average number of hours spent by OECD companies is 160 hours per year.

The use of technology to reduce tax compliance costs, through automation and simplification of the tax calculation and declaration process, becomes essential. In this context, new skills emerge for professionals working in this area, as well as a new field of application for concepts such as Artificial Intelligence, Machine Learning, Big Data, Cloud Computing, Low Code and Microservices. Via's fiscal transparency report, published for the 2022 financial year, shows that the company delivered more than 40 thousand additional obligations, through the Federal, State and Municipal Government portals. This number does not consider the number of electronic invoice files transacted, nor tax payment documents, only the declaration files required by current legislation.

More than half of global executives believe that, over the next three to five years, the tax area will demand professionals with skills to analyze data and present strategic insights, as the Tax Transformation study, by Deloitte, points out. This perception reflects the growing importance of data-based decision-making, given increasing government requirements for direct access to companies' tax data. The research also highlights the relevance of information security, which has gained focus on the concerns of national and international companies.

The volume of data is also impressive, therefore, technologies such as Machine Learning, Big Data and cloud storage, to deal with the immensity of data handled by companies, become a competitive differentiator. To deal with this entire mass of data, it is necessary to develop robust applications capable of converting data into information quickly and efficiently, without the user being impacted by slowdowns in the tools. Concepts such as Algorithm Optimization, Parallelization and Distribution, Microservices Architecture and the efficient use of computational resources must be employed by the technology team. All this without leaving aside the usability of the tools.

Knowledge of computer programming is just one part of the vast spectrum of this transformation. It can be seen, therefore, that the opportunities are not limited to those who want to “get their hands on the code”. There are opportunities for different profiles when it comes to the use of technologies in the tax sector.

Finally, we emphasize that the Tax Reform is far from diminishing the importance or scope of action of technology; in fact, it further consolidates its relevance in the current scenario. The recent text approved by the Senate not only maintains, but expands the visibility and workload for those involved in the tax environment. Rather than representing an obstacle, this reform reveals itself as a robust source of opportunities for the future of tax technology.

*Vinicius Oliveira, has a Bachelor's degree in Information Systems, co-founder and DPO of Tax Strategy.

*Helder Santos, is a Researcher at Think Tank – Center for Intelligence, Public Policies and Innovation, master and PhD student in Accounting and Controllership at USP, co-founder and CEO of Tax Strategy.

Notice: The opinion presented in this article is the responsibility of its author and not of ABES - Brazilian Association of Software Companies