8 out of 10 are not negative (80.5%); Impulsa Startups Program will accelerate companies that promote financial inclusion

An unprecedented study by Serasa Experian identified 35.3 million Brazilians without financial records, that is, 21.7% of the country's adult population do not have consumer accounts, financing, loans or credit card invoices registered in their CPF, not even are in the Positive Register. Also called “Thin Files” or literally “people without credit information”, they are usually individuals who do not use credit regularly and, therefore, do not have any recent activity in their history, as well as young people who have not yet started their financial life and have no charges.

Despite little information, these people are not out of financial services due to non-payment of any debts. Eight out of 10, or more precisely 80.5%, of people without credit information are not negative. Even so, as the market ends up having little or no information about the person's history, this scenario can negatively impact your credit score, which is a relevant score to obtain approval for loans, credit cards and other non-financial services. , but also as telephony, internet etc.

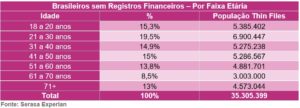

Still in the national analysis, the survey also brings the breakdown by age, which shows that most Thin Files (19.5%) are between 21 and 30 years old, followed by Brazilians aged 18 to 20 years (15.3%). The smallest share of people without financial records are those between 61 and 70 years old (8.5%). See the chart below with all age groups:

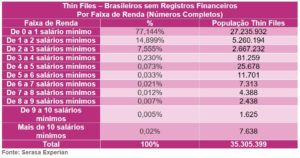

Regarding the income of these people, most earn between 0 and 1 minimum wage (77.14%) and less than 1% receive more than 4 minimum wages. See the table below for complete information:

“Not always being invisible to credit means that the person is not a good payer. Often, they may not have financial records because they choose to pay in cash or because they have their main accounts in family names, for example. The problem is that these people may have difficulty accessing credit or even when they do, they find lower limits and higher interest rates, as the market still does not know their financial behavior” explains Roger Cruz, Head of Sustainability at Serasa Experian .

The need for access to credit is commonly understood as support for emergency situations or even indiscipline with accounts, but it is important to make Brazilians aware of credit as a measure of financial inclusion. Access to credit can open the door to making dreams come true, such as studying, buying your own home, starting a business, taking a trip, or even taking care of your health, adds Roger Cruz.

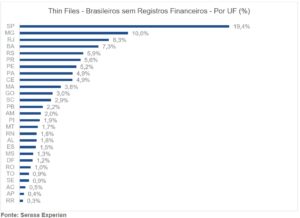

Top 3 states with the most Thin Files are in the Southeast

The states of São Paulo (19.4%), Minas Gerais (10%) and Rio de Janeiro (8.3%) led the ranking with the highest share of Thin Files, or people without financial records. The states of Acre (0.5%), Amapá (0.4%) and Roraima (0.3%) had the lowest participation. Below, see the complete survey by Federative Units (FUs):

Task force to boost financial inclusion in Brazil

Roger Cruz explains that being invisible to financial services does not mean a lack of money. There are more than 35 million Brazilians, and most of them generating income. In addition to a social opportunity, financial inclusion is a business opportunity

“Ensuring access for people and entrepreneurs to the financial system can bring benefits to companies that, by adapting their products to the needs of this public, can have a new source of income. For consumers and entrepreneurs, it expands the possibility of obtaining credit in the market, making the engine of the economy turn and creating a healthier society from an economic point of view”, says the Head of Sustainability at Serasa Experian.

Therefore, Serasa Experian, in partnership with ACE Cortex, will accelerate startups across the country whose products have the potential to transform the financial health of Brazilians. With the aim of fostering innovation and at the same time generating social impact, the “Boost Startups” program, will select 6 companies with scalable models that can promote the financial inclusion of consumers and entrepreneurs through their products.

Methodology

The “Thin Files” study was produced by Serasa Experian in March 2023. For the production of the survey, Serasa Experian considered “Thin Files” Brazilians registered in the company's database who have the CPF Inscribed in the Positive Register, but not have no objective payment information and people who were registered in the Positive Register, but who asked to be unsubscribed (representing less than 1% of the total).