– Chief Information Officers (CIOs) pause new spending due to uncertainty

– 62% of Chief Executive Officers (CEOs) and senior executives identify AI as the factor that will define the future of competitiveness in the next 10 years

– 61% of companies started 2025 in a better position than at the same time last year; only 24% expect to end the year ahead of their 2025 plans

Worldwide IT spending is expected to total US$5.43 trillion in 2025, an increase of US$7.91 trillion from 2024, according to the latest forecast from the Gartner, Inc..

“While there is a pause in business regarding new spending due to increased global uncertainty, the effect is offset by continued digitalization initiatives with Artificial Intelligence (AI) and Generative Artificial Intelligence (GenAI)", it says John-David Lovelock, Vice President Distinguished Analyst at Gartner. “For example, software and services spending growth in 2025 is expected to slow due to this 'uncertainty pause,' but spending on AI-related infrastructure, such as Data Center systems, continue to increase.”

Global IT Spending Forecast (Millions of US Dollars)

|

|

2024 expenses |

2024 Growth (%) |

2025 expenses |

2025 Growth (%) |

|

Data Center Systems |

333.372 |

40,3 |

474.883 |

42,4 |

|

Devices |

720.681 |

4,6 |

759.615 |

5,4 |

|

Software |

1.114.604 |

11,9 |

1,232.145 |

10,5 |

|

IT services |

1.614.756 |

4,8 |

1.686.321 |

4,4 |

|

Communication Services |

1.256.287 |

2,2 |

1.282.592 |

2,1 |

|

IT in General |

5.039.699 |

7,4 |

5.435.555 |

7,9 |

Source: Gartner (July 2025)

“Data centers are experiencing a GenAI-driven surge, with spending on AI-optimized servers, which was virtually nonexistent in 2021, expected to triple that of traditional servers by 2027,” says Lovelock.

This aligns with a Gartner survey of 252 senior leaders across industries in North America and Western Europe with enterprise-wide revenues of US$500 million or more, conducted from March to May 2025, in which 62% of respondents identified AI as a factor that will define competitiveness over the next 10 years. Competitiveness is the top reason companies will invest in technology and business change (64%) in an eroding environment.

“With the GenAI moving toward the Valley of Disillusionment, more time and expense is being focused on functionality already delivered by traditional software vendors,” says Lovelock. “The CIOs are looking for simpler, 'plug and play' use cases, as they are selling GenAI's functionality, but not necessarily buying the functionality.

Impacts of the pause due to uncertainty

Beginning in the second quarter of 2025, there was an "uncertainty pause," which included a strategic suspension of new initiatives across several departments, including IT. This pause is driven by increased uncertainty and geopolitical risks. In response, the global corporate sector is adopting greater caution as companies seek to mitigate the negative impacts of these multifaceted challenges.

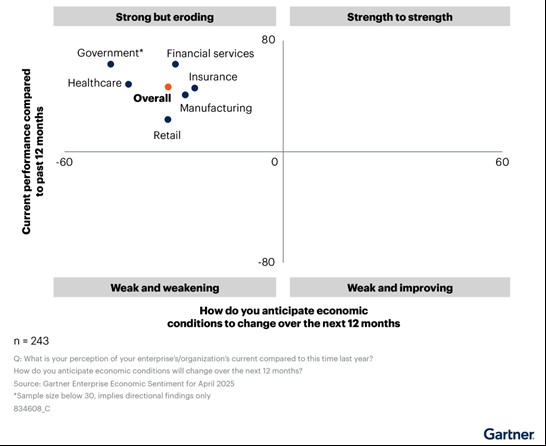

The same Gartner survey found that 61% of companies started 2025 in a better position than at the same time last year, but only 24% expect to end the year ahead of their 2025 plans. This sentiment was consistent across industries, to varying degrees.

Economic Sentiment of Corporate Executives

Source: Gartner (July 2025)

"This pause isn't due to budget cuts, as budgets remain fully allocated," says Lovelock. "Instead, it's a strategic decision to postpone new spending. The IT hardware and infrastructure sectors are particularly affected due to price increases and supply chain disruptions. In contrast, ongoing or recurring spending, such as managed and cloud services, is maintaining greater stability."

Economic (41%) and geopolitical (32%) shocks pose the greatest risks, according to business leaders. They believe they are prepared to successfully handle pressure from customers, competitors, and regulations.

Gartner's IT spending forecast methodology relies heavily on rigorous analysis of sales from more than a thousand vendors across the full range of IT products and services. Gartner uses primary research techniques, supplemented by secondary research sources, to create a comprehensive database of market size on which to base its forecast.

Gartner's quarterly IT Spending Forecast provides a unique perspective on IT spending across hardware, software, IT services, and telecommunications. These reports help Gartner clients understand market opportunities and challenges. The latest IT Spending Forecast research is available to Gartner clients atGartner Market Databook, 2Q25 Update”.

Topics like these and others aimed at CIOs (Chief Information Officers) and IT and business leaders, including insights and trends that shape the future, such as accelerating business transformation, modernizing applications, infrastructure and operations, will be highlighted in the Gartner CIO & IT Executive Conference 2025The event, which will be held from September 22nd to 24th in São Paulo, will showcase how leadership and innovation, combined with the adoption of cutting-edge technologies, play a fundamental role in corporate results. More information is available at: https://www.gartner.com/pt-br/conferences/la/cio-brazil

More information about the forecast can be found in Gartner's free webinar, “IT Spending Forecast, 2Q25 Update: Navigate the Complexities of the Current IT Landscape”.

Gartner customers can read more at “Competitiveness Will Drive Tech Investment as Enterprise Economic Confidence Erodes in 2Q25”.

About the Gartner CIO & IT Executive Conference

Gartner analysts will provide additional analysis on insights and trends shaping the future of IT and business, including accelerating enterprise transformation, application modernization, infrastructure and operations, during the Gartner CIO & IT Executive Conference, which will be held September 22-24 in Sao Paulo and from October 6th to 8th in Dubai. Follow the conference news and updates on X using #GartnerCIO.

About Gartner for High Tech

The Gartner for High Tech helps technology leaders and their teams with role-based best practices, industry insights, and strategic insights into emerging trends and market shifts so they can achieve their mission-critical priorities and build the successful companies of tomorrow. For more information, visit: www.gartner.com/en/industries/high-tech. Follow the news and updates from Gartner for High Tech at X and in LinkedIn using #GartnerHT.

About Gartner

O Gartner, Inc. delivers objective, actionable insights that drive smarter decisions and better performance for enterprises’ mission-critical priorities. To learn more, visit www.gartner.com.