According to research carried out by Brasscom, in January 2024 alone, 80,975 jobs were created in the 17 sectors exempted by the policy

THE Payroll exemption is the tax replacement of the conventional social security contribution, 20% on the value of each employee's remuneration, with a single tax on the company's gross revenue. Brasscom, Association of Information and Communication Technology (ICT) and Digital Technologies Companies, launched new data which reinforce the effectiveness of the country's development policy. There are 9,146,108 formal jobs in the 17 exempt sectors at the end of 2023, and in January 2024 the generation of jobs was surprising, 80,975 new jobs were created. Thus, the recorded growth of the 17 sectors together was 0.9%, while national jobs had a lower growth of 0.3% in January 2024.

In January 2024, the average salary of the 17 Sectors was 15.4% higher than the sectors without tax relief. In short, without the policy, 815,382 jobs would no longer be created in the period from January 2019 to January 2024.

In January 2024, the average salary of the 17 Sectors was 15.4% higher than the sectors without tax relief. In short, without the policy, 815,382 jobs would no longer be created in the period from January 2019 to January 2024.

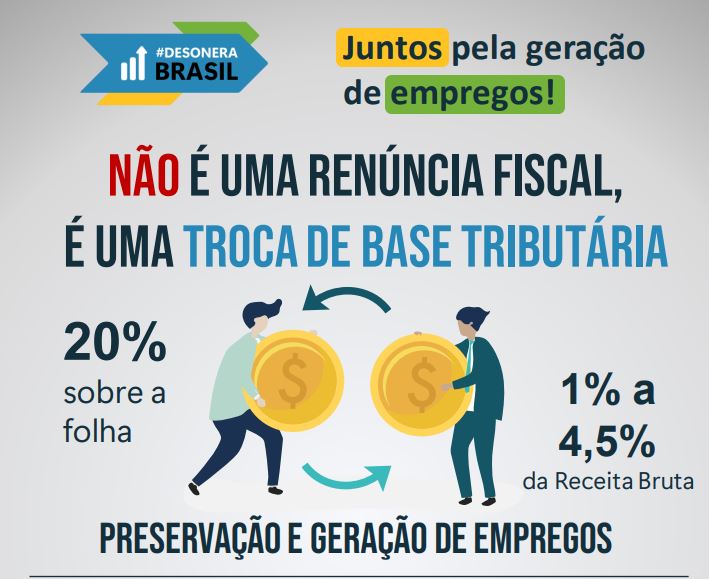

The exempted sectors argue that the measure is not a tax waiver, but a different way of making the payment, taking into account the company's gross revenue. Fiscal policy generates more collections for the FGTS and brings with it less social costs with unemployment benefits, according to the associations.

Rapporteur of the proposal, deputy Any Ortiz (Cidadania-RS) signaled that she must maintain, in the opinion of the new PL sent by the Federal Government, the payroll tax exemption for 17 sectors of the economy until 2027. “It is important to reinforce that competitiveness today It is also one of the reasons why the payroll tax relief was created, both for the competitiveness of companies in the domestic and foreign markets”, he states.