Credit: Jonas Pereira/Agência Senado

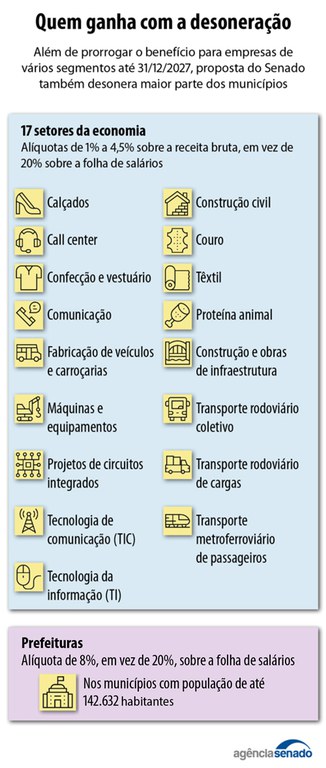

The Senate Plenary approved the bill that extends, for another four years, the so-called payroll tax exemption, a type of tax incentive aimed at 17 large sectors of the Brazilian economy that employ the most. PL 334/2023 now goes to sanction or veto by the Presidency of the Republic.

The author of the project is senator Efraim Filho (União-PB). The payroll tax exemption was implemented as a temporary measure in 2012, having been extended since then. The current exemption is valid until December 31, 2023, that is, the approved project determines the extension from January 1, 2024 until December 31, 2027.

“Companies need legal security to be able to have time to open new branches, expand their business and, therefore, hire more people, which is the purpose of this public policy, to remove fathers, mothers and young people from the unemployment line and, with sweat of your face, put bread on the table in your house”, stated Ephraim.

The matter, reported by senator Angelo Coronel (PSD-BA), relieves the payroll by allowing the company to replace the payment of 20% tax on its payroll with rates of 1% up to 4.5% on gross revenue.

“These are the sectors that employ the most in Brazil, and maintaining tax relief is extremely important to maintain jobs,” said the rapporteur.

“These are the sectors that employ the most in Brazil, and maintaining tax relief is extremely important to maintain jobs,” said the rapporteur.

Senator Carlos Viana (Podemos-MG) defended the approval, as he understands that increasing the tax burden on productive sectors chokes the market and harms the economy.

The president of the Senate, Rodrigo Pacheco, stated that the extension of the exemption “is a boost for sectors with high employability and which obviously need to be recognized”.

To compensate for the decrease in government revenue, the approved project also extends the 1% increase in the Cofins-Importation rate until December 2027.

The Executive Branch will have to define mechanisms for monitoring and evaluating the impact of payroll tax relief on the maintenance of jobs in companies, the text provides.

Efraim Filho argues, in justifying the project, that it is necessary to maintain tax relief in the face of a scenario of inflation and high interest rates and the uncertainties of the world economy. According to him, the measure “is in line with the constitutional principle of seeking full employment”. The senator also states that the exemption does not result in less social investment.

“The idea is that this mechanism will enable the opening of more jobs. Regarding the financial and budgetary impact, we understand that the incentives provided for in the project have existed for years and do not constitute a relevant innovation in the legal system”, states Angelo Coronel in his report.

During the vote in the Plenary, he accepted and the senators approved an article included in the Chamber of Deputies that provides for the reduction of the rate from 2% to 1%, until December 2027, for collective road passenger transport companies, with fixed itinerary, municipal, intercity in metropolitan, intercity, interstate and international regions. All other changes by the Chamber were rejected.

Small municipalities

The approved text determines the reduction, from 20% to 8%, of the social security contribution rate on the payroll of municipalities with a population of up to 142,632 inhabitants.

“It is a matter of justice to reduce the tax rate from 20% to 8%. It is worthy, everything happens in the municipalities, we cannot sacrifice these Brazilian municipalities that have a population below 142 thousand inhabitants. Those with a population above 142 thousand inhabitants already have an increase in the Participation Fund”, said Angelo Coronel.

The measure will benefit more than 3 thousand municipalities and around 40% of the Brazilian population, according to him.

“Although the measure has a relevant impact on the services provided by city halls, reinforces the funds of federated entities and enables a better life for people in the most needy regions, there is no fiscal impact on the public sector, as it is an improvement of the pact federative — the Union stops collecting contributions from municipalities, having a neutral net effect on the public sector. In numbers, the federal government would no longer collect R$ 9 billion annually, amounts reduced compared to the benefits to other federated entities”, analyzes the rapporteur.

According to him, the benefit to these municipalities is justified because the legislation equates them to companies for the purpose of collecting social security contributions, but, although it allows differentiated social security contribution collection rates depending on the size of the companies, it does not do the same in relation to municipalities . He remembers that more than half of the municipalities that were not covered by the Federal Senate are, in terms of GDP per capita, among the richest in the country.

“We reiterate the positive impacts of the measure on the labor market, employment and income. Although the tax expenditure of the exemption is estimated by the Federal Revenue of Brazil at R$ 9.4 billion, the positive effect on the economy exceeds R$ 10 billion in revenue, considering the addition of more than 620 thousand jobs in the 17 exempted sectors in 2022 and the resulting from growth in revenue from taxes and contributions”, ponders Angelo Coronel.

Source: Senado Agency