Information delivered via WhatsApp brings innovation to the agricultural scenario and facilitates repeat requests

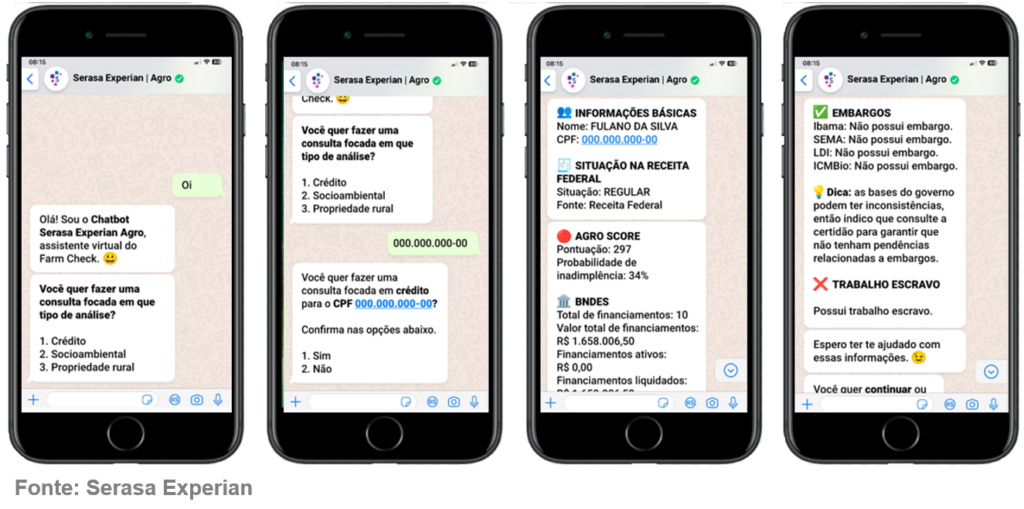

Keeping up with market trends and the needs of Brazilian agribusiness, which has become increasingly technological, Serasa Experian is developing Chatbot Agro, a solution that uses artificial intelligence with the Brain platform database and information recently acquired from Agrosatélite , in up to 90 seconds, to deliver simplified and secure credit analyzes for input suppliers, distributors or agents of rural industries. Also benefiting the producer, who is waiting for the concession and needs quick access to the financial resource throughout his productive journey, the Chatbot Agro can be consulted via WhatsApp and works in a practical automated way. Check it out in the photos:

The Serasa Experian Agro Chatbot is an agile and flexible solution for decision makers in the field, where access to a desktop may be limited or non-existent. Utilizing artificial intelligence, the Chatbot can provide relevant information, data analysis and insights in real time, directly on a mobile device. This allows decision makers to access critical information and make informed choices quickly, even in remote or challenging environments, while staying connected to essential information that guides the decision process.

In addition to all the benefits, the new tool will be able to optimize a process that is very common in agribusiness, as explained by Serasa Experian's executive director of Agribusiness Operations, Renato Girotto, "the granting of credit in the inputs segment is generally done on a once a year, when the producer foresees the amount he will need to pay for his entire production cycle. However, adverse situations may occur, such as weather changes or unexpected conditions, which make it necessary to request a raise, that is, credit demands that exceed what had been estimated, but help to continue production without major losses. For this, in a safe scenario, the financial and socio-environmental profile assessments should be redone”.

“Today, the Chatbot that we are developing specifically for the rural sector will bring an extra benefit to creditors, because before this new solution and the Brain platform they ended up with only two options: granting credit at serious risk of default, reputation, image and even ESG-related fines or not accepting the loan, failing to do business and making it difficult for the producer to act. In this way, the tool will reinforce and bring more agility to one of the main assumptions of Serasa Experian, which is the democratization of rural credit”, concludes Renato Girotto.

The Serasa Experian Agro Chatbot is in the testing phase, it brings credit data related to rural producers, in addition to verifying agro properties and considering ESG criteria. With access to this data in the palm of their hand, since they are consulted by cell phone, creditors are able to make a safer and more transparent decision, mitigating socio-environmental and default risks. In this way, the financial resource for a possible moment of resurgence or urgency can be approved and reach the rural producer in a dynamic way.