The main target of the scammers is the public between 36 and 50 years old.

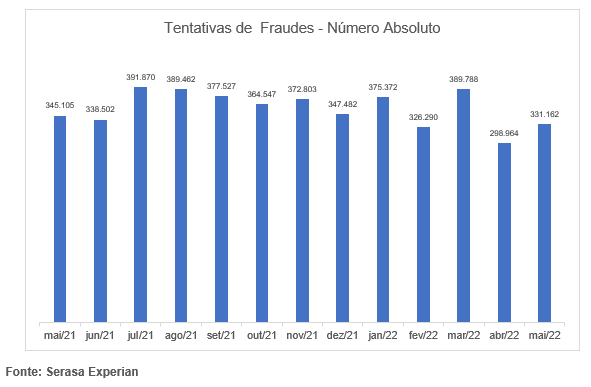

In may 331,162 Brazilians were victims of fraud attempts according to the Serasa Experian Indicator that maps these actions. The number represents that every 8 seconds someone tried to apply a coup in the country. The main target of fraudsters was the Banks and Cards segment with 53.3% of all investees. The study analyzes identity misuse numbers, such as opening accounts and even issuing cards. In second place is the Financials segment, with 17.1%, followed by Services, 16.1%, Retail, 10.6%, and Telephony, which represents only 3% of the total attempts. See the total numbers in the chart below.

Regarding the age group, the most affected group is the one that includes people between 36 and 50 years old. This parcel fell victim to 36.1% of the attempts. The public between 26 and 35 years old occupies the second position in the ranking of the most targeted by fraudsters, occupying a share of 27.5% of the total. Thirdly, people aged 51 to 60, with 14%. Then, people up to 25 years old, with 11.4% and, finally, the group of people over 60 years old, with 10.9%.

According to the Head of Identity Verification and Fraud Prevention Products at Serasa Experian, Caio Rocha is important for users to be careful when sharing their personal data. “Criminals are always developing new ways to deliver their scams. Taking care of where you enter your information and with whom you share it is essential to ensure security in the transactions carried out. In the case of online purchases, it is important to always check the origin of the portals and to check the experiences of other users”.

When we analyze the regions, most of the coup attempts took place in the Southeast, 52.1%. The Northeast recorded 17.3% of fraudsters' attacks. South, 16.6%, Midwest 8.9% and, in the last position, is the North, with 6.1%.

Methodology

O Serasa Experian Fraud Attempts Indicator - Consumer it is the result of crossing two sets of information from Serasa Experian's databases: 1) total number of CPF queries carried out monthly at Serasa Experian; 2) estimation of fraud risk, obtained through the application of probabilistic fraud detection models developed by Serasa Experian, based on Brazilian data and global Experian technology already consolidated in other countries. The Serasa Experian Fraud Attempt Indicator – Consumer is formed by multiplying the number of CPFs consulted (item 1) by the probability of fraud (item 2).